OVERVIEW

Last week was a “go nowhere” kind of week for the U.S. stock market. The S&P 500 showed a slight dip of 0.1%, while the Dow declined by 0.23%, and the Nasdaq dropped approximately 0.42%. Upon closer examination, growth stocks remained stagnant, while value stocks only fell by 0.08%. Small-cap stocks experienced slightly larger losses at around 0.31%.

Foreign stocks exhibited a mixed performance for the week, with developed country stocks edging higher by just 0.03%, while emerging market stocks suffered a significant decline of nearly 2%, making them the biggest loser in the equity space.

In the bond market, losses were generally subdued, as the benchmark 10-year Treasury rose to 3.58% from 3.52% the previous week. Intermediate-term Treasuries dipped by 0.25%, and long-term Treasuries declined by 0.54%. Investment-grade corporate bonds also fell by about 0.22%, and high-yield (junk) bonds decreased by approximately 0.33%.

Real estate was the top performer for the week, gaining about 1.45%, while commodities experienced declines of just over 2% across the board. Oil was down by 5.4%, gold fell by 1.26%, and corn dipped by 3.22%. The U.S. dollar, on the other hand, ended the week stronger, gaining about 0.25%.

KEY CONSIDERATIONS

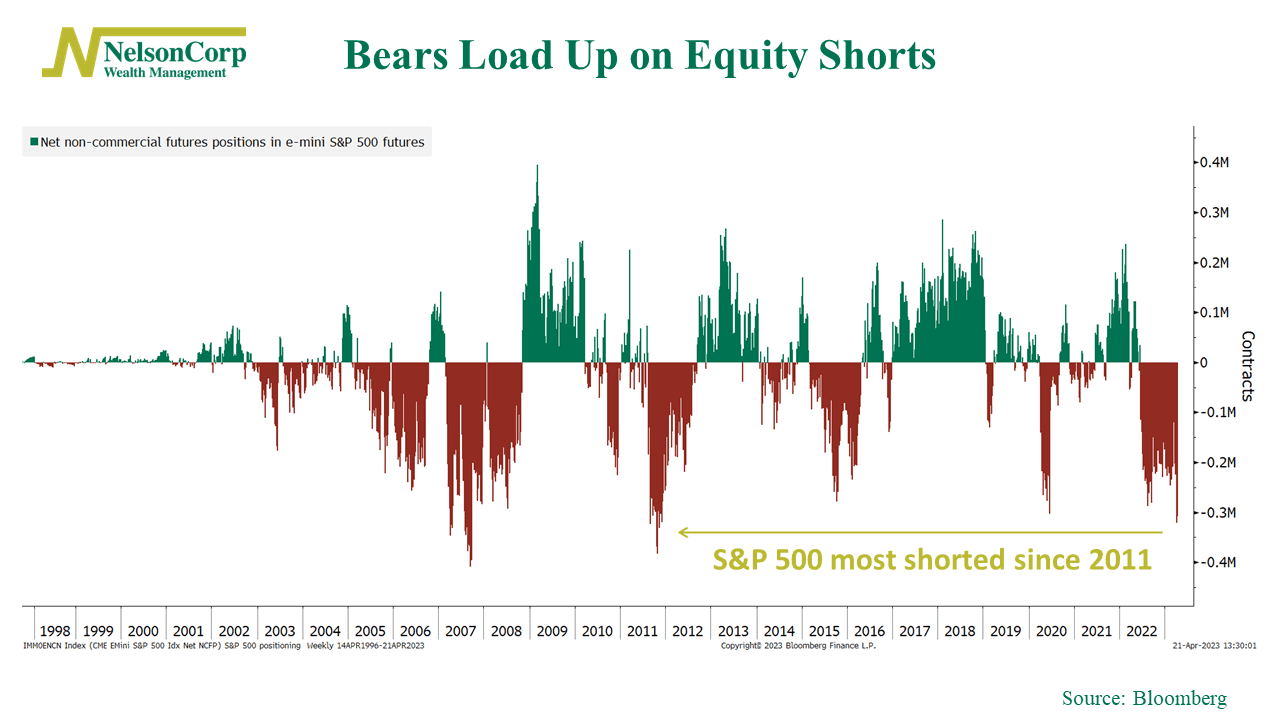

Too Short to Ride? – Here’s an interesting chart I’ve seen floating around recently, illustrating the extent to which market participants have been shorting, or betting against, the S&P 500 stock index.

A negative reading indicates that investors are net short the market; in other words, they are anticipating it to decline. Surprisingly, there have been only a few instances in history where the market has been this heavily shorted.

While this might initially seem like a cause for concern, it could actually be a positive sign for future stock returns. When market sentiment becomes extremely one-sided, the consensus often tends to be incorrect. In fact, some of the best opportunities in the stock market arise when the majority of investors are heading in one direction.

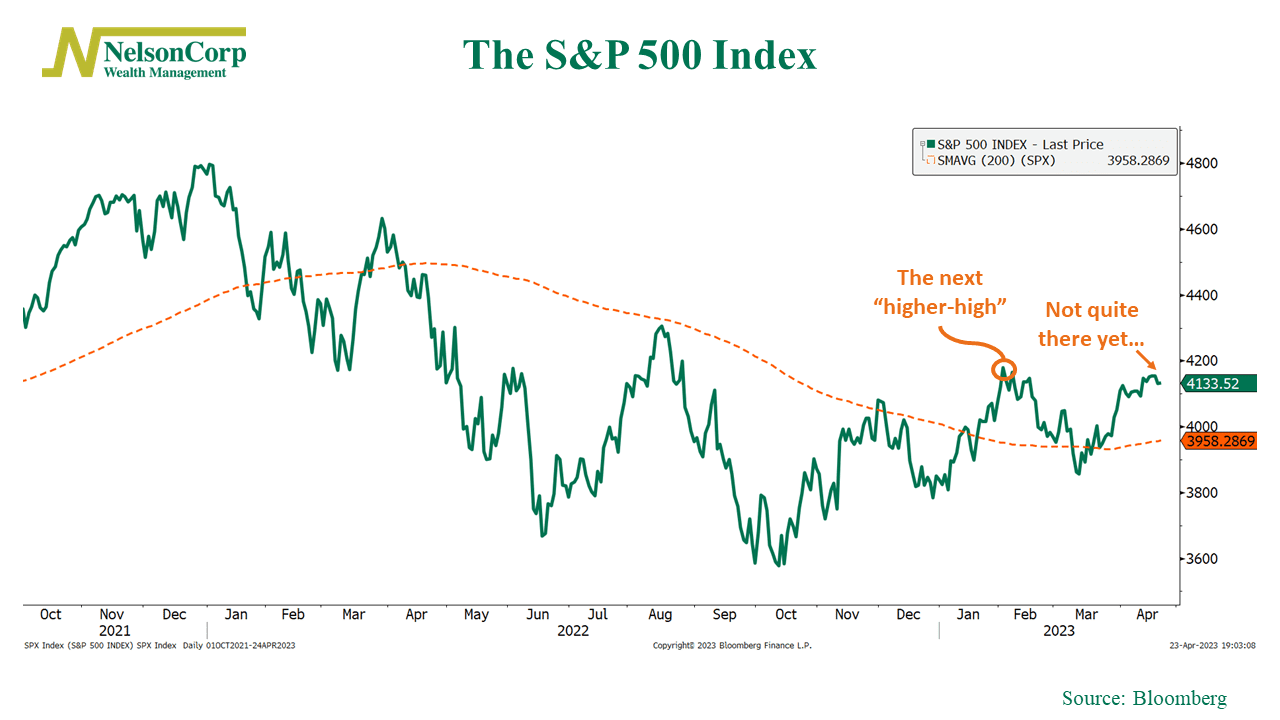

To gain a more concrete understanding, we also pay close attention to the price action of the stock market, specifically the actual movements of prices. Currently, things are looking positive, as the S&P 500 has been trending higher for over a month, and the uptrend that began in October of last year appears to still be intact.

The next test for the market will be at the 4180 level on the S&P 500 Index, as highlighted on the chart. This would mark the next “higher-high” for the index, a significant technical level. Although the market failed to breach this level last week, we would like to see it surpass it at some point in the future to confirm that the uptrend is still in place.

So, in a nutshell, while the high level of short interest in the stock market may initially seem concerning, it could actually indicate a potential opportunity for positive returns. If the current uptrend in stock prices continues, the substantial short interest may even provide a boost for stocks in the future as short sellers close out their positions and the market squeezes higher.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Too Short to Ride? first appeared on NelsonCorp.com.