OVERVIEW

The major U.S. stock indices were mixed last week, with the S&P 500 falling 0.71%, the Nasdaq declining 1.57%, and the Dow gaining 0.11%.

Large-cap and growth stocks led the declines lower, falling about 1.13% and 1.7%, respectively. Small-cap stocks fared better, falling 0.7%, and value stocks managed to gain about 0.3% for the week.

Foreign stocks did well relative to domestic stocks. Developed country markets rose about 0.22%, and emerging markets rose about 0.08%.

Bonds were down across the board as the yield on the benchmark 10-year Treasury note rose to its pre-pandemic level of 1.34%.

Real estate suffered too, falling about 0.75%.

Commodities, however, were mixed. Oil fell after climbing above $60/barrel, gold declined about 2.5%, and corn prices rose nearly 1%.

The U.S. dollar ticked lower, falling about 0.16%.

KEY CONSIDERATIONS

Small Goes Big – Spending in the United States picked up in a big way recently after a three-month decline during the holiday season. Retail sales, a measure of spending at stores, jumped a seasonally-adjusted 5.3% in January from a month earlier.

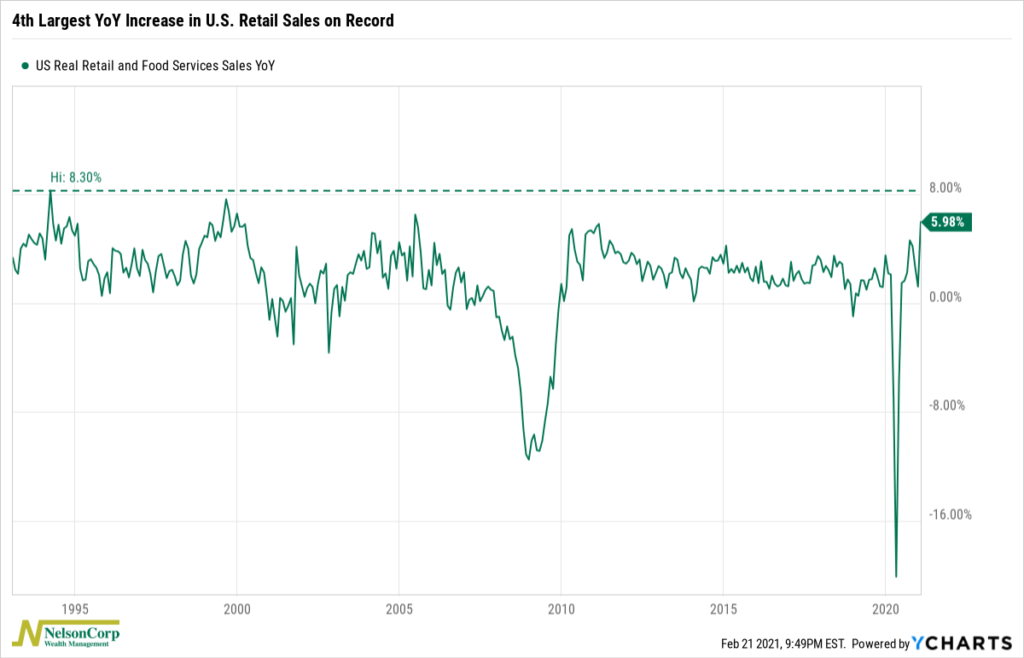

Relative to a year ago, retail sales jumped nearly 6%, the fourth-largest year-over-year increase on record, as shown on the chart below.

This is a pretty encouraging sign for the economy, as it shows that consumer spending, which accounts for roughly 70% of our GDP, is currently firing on all cylinders. Indeed, the Federal Reserve Bank of Atlanta is now predicting that GDP will grow at a 9.5% rate in the first quarter, a big jump from their previous estimate of 4.5% just a week ago.

The stock market has not been blind to this good news. In fact, the stock market is a forward-looking machine, so much of this positive news on the economy and, by extension, corporate profits has been priced into the S&P 500 index over the past handful of months; the index is up around 75% from its pandemic-era low last March.

But the S&P 500 represents the largest companies in the United States, many of which thrived during the stay-at-home orders implemented at the start of the pandemic. Interestingly, we’ve actually begun to see the smaller companies outside of the large-cap space do particularly well lately.

The chart below shows the performance of the S&P 600 index versus the S&P 500 index over the past year. The S&P 600 represents the small-cap stocks in the U.S., meaning market caps of roughly $700 million to $3.2 billion.

As we can see, small-caps surged ahead of large-caps earlier this year, and they haven’t really shown any signs of slowing down. We can take this as a sign of increased risk appetite among U.S. investors, as well as a sign that economic growth is indeed looking brighter. It also provides us with opportunities to take advantage of new return sources, as long as the price trend remains favorable.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Small Goes Big first appeared on NelsonCorp.com.