OVERVIEW

U.S. stocks were mixed last week as the S&P 500 gained 0.58%, the Nasdaq increased 1.55%, and the Dow fell 0.24%. Growth stocks led the way, as the Russell 3000 Growth index rose 1.31%. Value stocks, on the other hand, fell 0.07% on the week.

In the international space, emerging market stocks had another strong week with a 3.4% gain. Developed country stocks also did well, notching a 1.7% gain.

Interest rates ticked up slightly, as the yield on the 10-year Treasury rate increased to 1.33% from 1.31% the prior week. Long-term Treasury prices were down about 0.39%. Investment-grade corporate bonds fell about 0.08%, whereas high-yield (junk) bonds rose 0.41%. Municipal bonds and inflation-protected Treasuries (TIPS) were down on the week, losing 0.27% and 1.05%, respectively.

Real estate had another great week, gaining 3.66%, bringing its year-to-date gain to over 30%. Commodities were up about 0.8% on the week. Oil rose about 1.06%, and gold gained 0.78%. Corn, however, was down around 5.4%. And finally, the U.S. dollar ticked lower by about 0.64%.

KEY CONSIDERATIONS

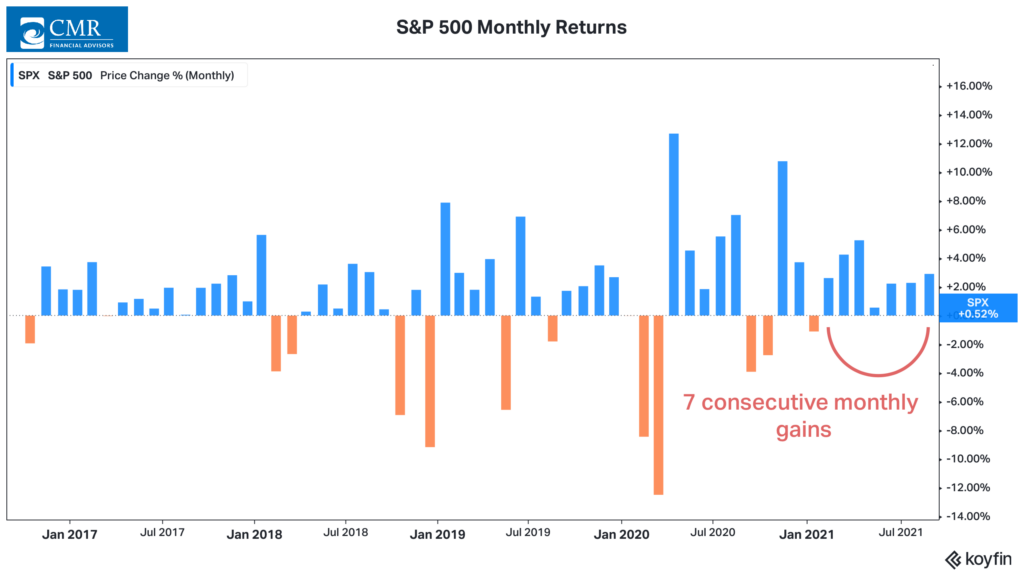

Feeling Streaky – The S&P 500 stock index is on a roll this year. After a 2.9% gain in August, the index has registered a positive gain for seven months in a row—its longest streak since a 10-month stretch that ended in January 2018.

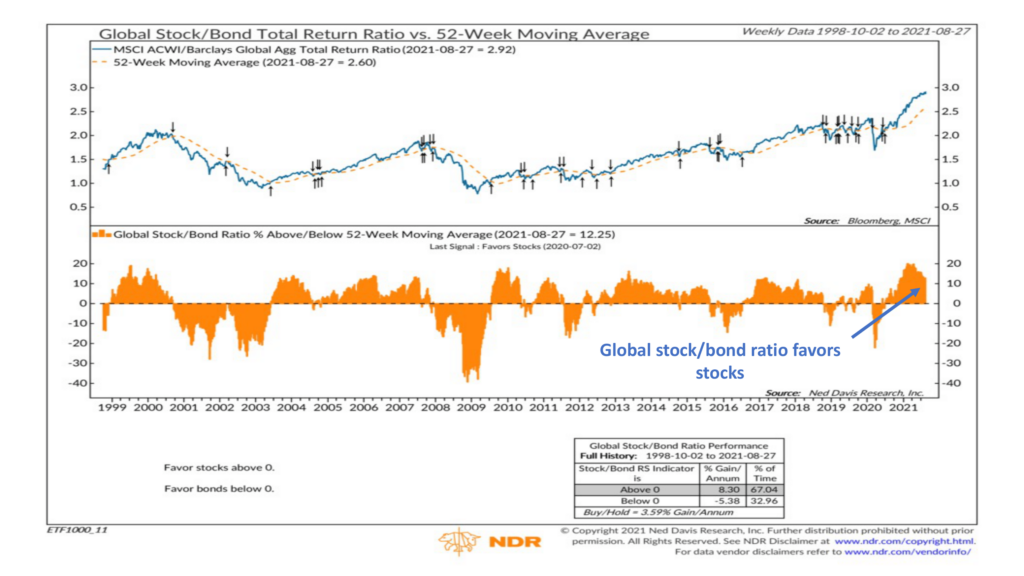

We’ve talked before about the strength of this new cyclical bull market. But to illustrate where this strength is coming from, it’s helpful to compare stocks on a relative basis to bonds.

The chart below shows the relative performance of global stocks versus bonds. In the top clip, we have the ratio of the MSCI All-Country World stock index to the Barclays Global Agg bond index, coupled with the ratio’s 52-week moving average. The bottom clip shows the global stock/bond ratio’s percentage above or below this 52-week moving average. When it’s above zero, it means global stocks are in a long-term uptrend relative to global bonds; below zero, bonds are trending upwards relative to stocks.

According to the chart, stocks have been the better bet for more than a year now. The ratio peaked relative to its 52-week moving average in the second quarter of this year. But at roughly 12%, the ratio is still hovering around historically high levels relative to its 52-week moving average—a bullish sign for global stocks.

One reason for all this is there’s a lot of liquidity out there. And like an actual liquid, money is searching for a place to go.

It found a receptacle in stocks. In a world of T.I.N.A (There Is No Alternative), investors have moved out on the risk spectrum searching for higher yields. So, with this much capital flowing into stocks, we’re bound to see monthly winning streaks like the one we see this year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Feeling Streaky first appeared on NelsonCorp.com.