OVERVIEW

The U.S. stock market was mixed last week. The S&P 500 lost 1.55%, and the Nasdaq Composite dropped 3.11%. However, the Dow Jones Industrial Average registered gains of 1.15%.

Foreign stocks declined, with developed country markets dropping 1.35% and emerging markets suffering declines of 3.83%.

Bonds traded lower as interest rates climbed. The 10-year Treasury note’s yield rose to 4.02% from 3.89% the week before. Intermediate-term Treasuries lost 0.78%, and long-term Treasuries fell 2.4%. Investment-grade bonds declined around 1.6%, and high-yield (junk) bonds decreased 1.11%.

Commodities fell nearly 3% broadly. Oil led the way lower, losing around 6.6% on the week. Gold dropped 3.5%, and corn gained 0.95%. Real estate fell 1.7%. And finally, the U.S. dollar strengthened more than 0.5% to end the week.

KEY CONSIDERATIONS

Macro Take the Wheel – Halloween is still a couple of weeks away, but Wall Street analysts are already getting spooked this earnings season.

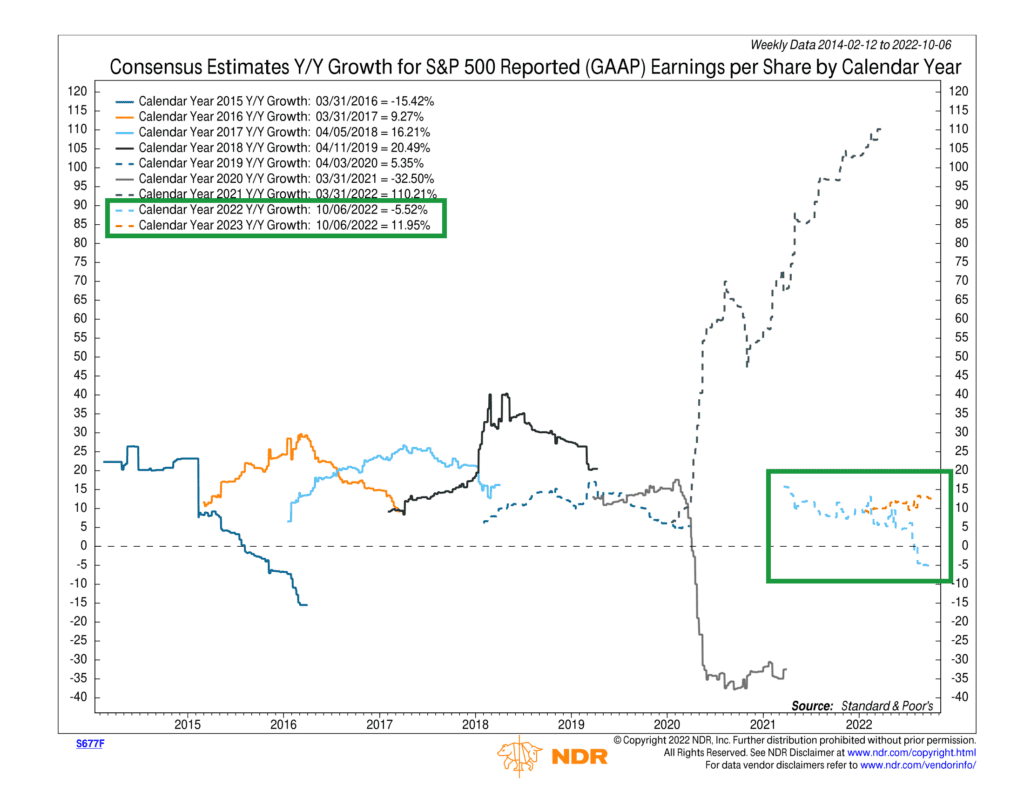

In this week’s Chart of the Week blog post, we pointed out that analysts started the year with a rosy outlook for corporate earnings. They expected S&P 500 earnings per share to grow about 10% from a year ago.

However, those expectations have since deteriorated, and analysts are now projecting earnings to fall at a rate of -5.5% for the year.

Talk about hitting the brakes!

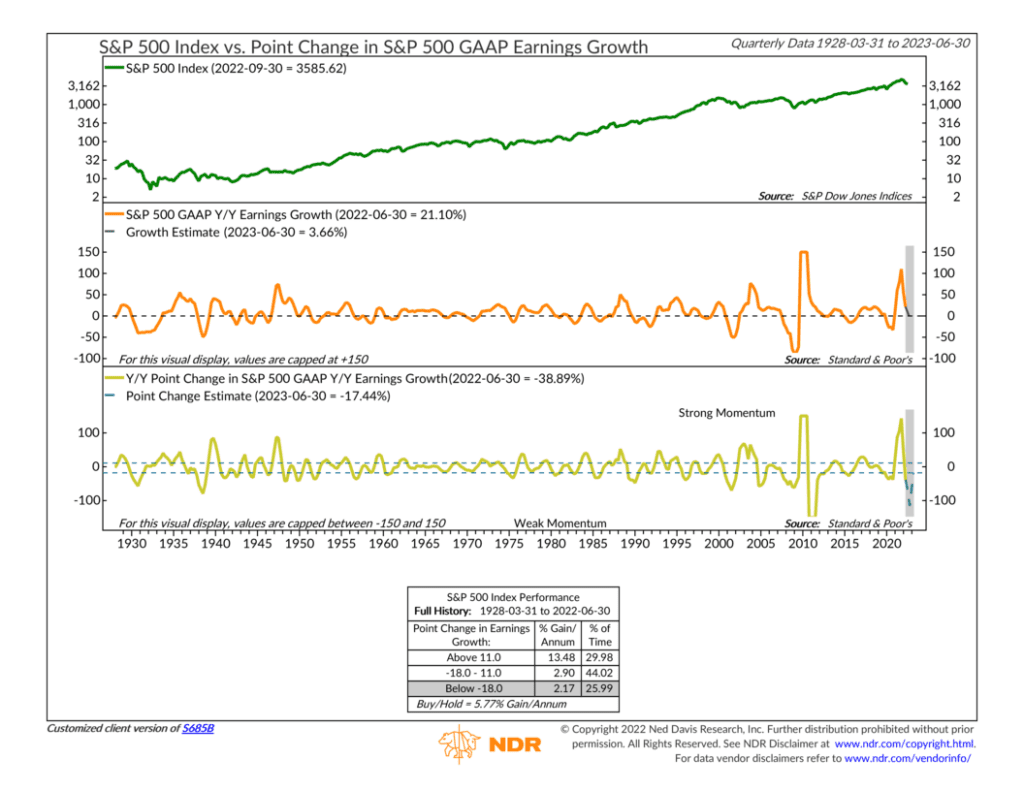

As our Indicator Insights post indicated, these analyst downgrades have come amid the fastest earnings growth deceleration since 2011.

In the second quarter, S&P 500 earnings grew 21% versus a year ago. The problem? That was nearly 40 percentage points slower than the 60% growth rate in the second quarter of 2021.

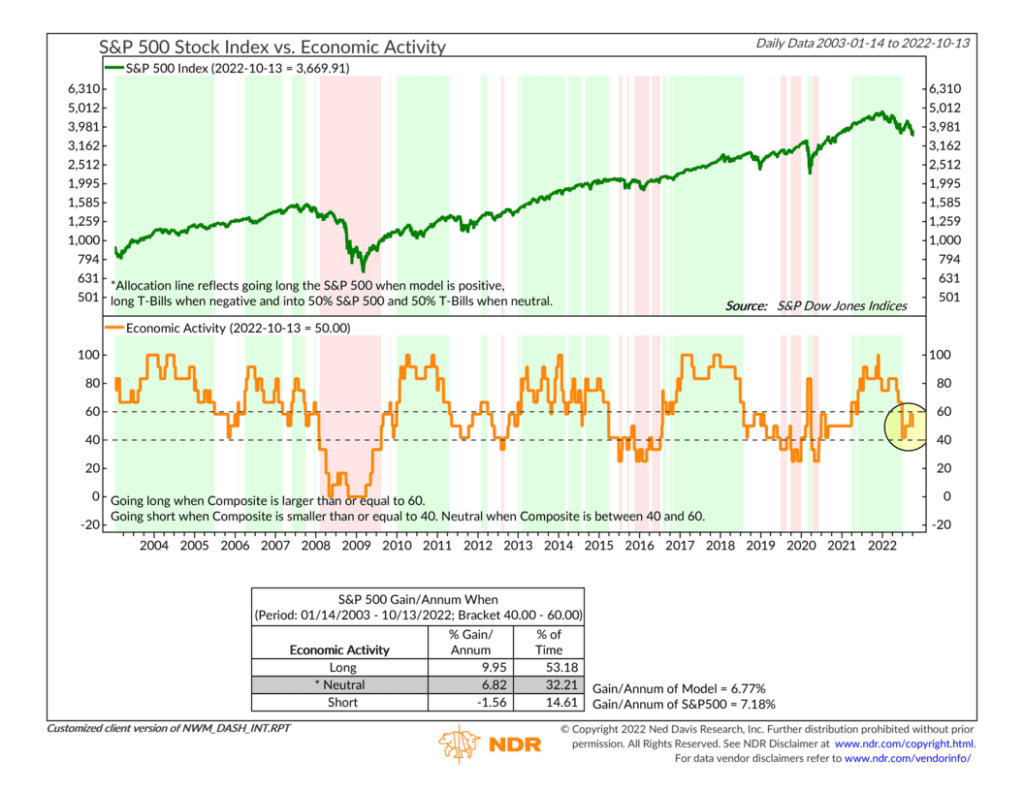

All this has led our Economic Activity composite—1/3rd of which is comprised of earnings-based indicators—to deteriorate significantly.

As you can see, this composite had been positive up until the end of the second quarter—a sign that the underlying economic backdrop was still strong.

But now, with the earnings outlook starting to deteriorate, there isn’t much left to keep it upright. It’s mostly neutral at this point.

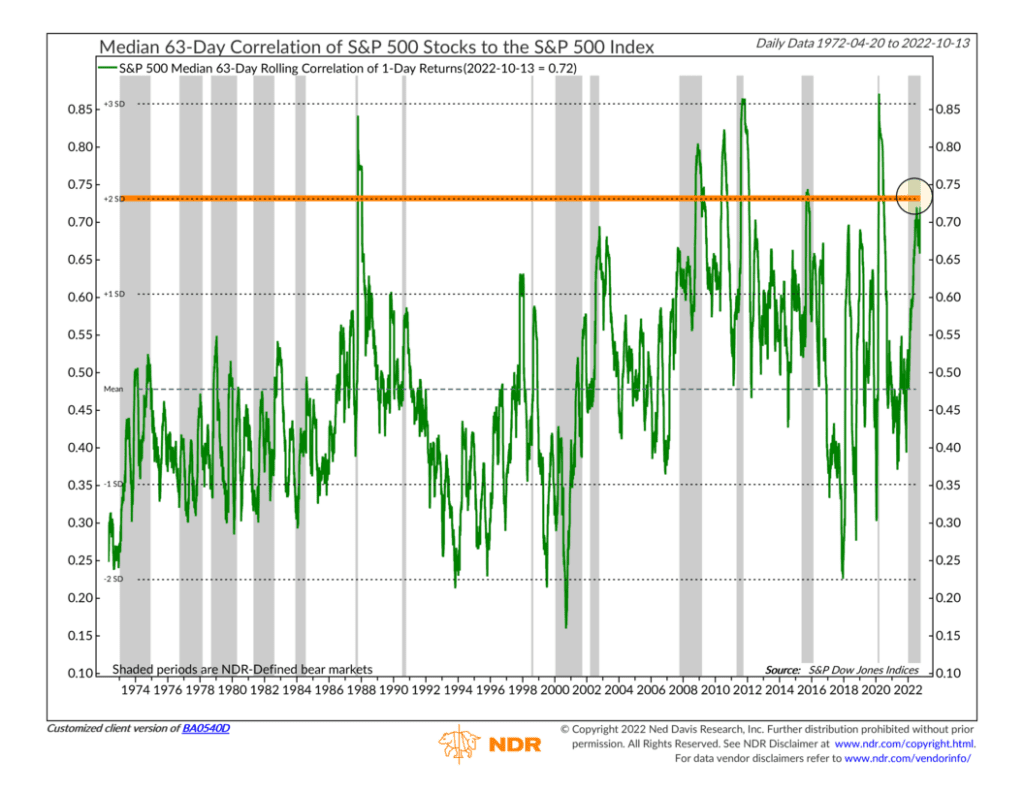

This has implications for the stock market because the evidence shows that the market has been moving in a more concerted fashion lately. That is to say, much of the stock market’s daily price action is being driven by broader macroeconomic news—things like corporate earnings, inflation, and the Fed—as opposed to narrower stock or industry-specific news.

To visualize this, we like the chart below, which shows the average S&P 500 stock’s 3-month rolling correlation with the S&P 500 index itself. In other words, it shows how closely the average stock is moving in relation to the market as a whole. The higher the number, the higher the correlation.

The current reading of 0.72 is extremely high, nearly two standard deviations above the average reading. Basically, it doesn’t matter what sort of stock you own in this environment; it’s likely going up or down with the rest of the stock market.

In portfolio theory, this is called systematic risk. Unsystematic risk—the stock or industry-specific risk—can be diversified away by owning a bunch of different stocks. But the systematic risk you can’t get rid of. This is the risk inherent to the entire market, and when stock correlations are high, systematic risk is also high.

That’s why we emphasize tactical risk control. The weight of the evidence tells us when the macroeconomic environment has deteriorated to a point where the risk-return tradeoff for owning stocks has weakened. Portfolio adjustments can then be made to better align the asset allocation with the overall investing environment—which has been very poor for risk assets this year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Macro Take the Wheel first appeared on NelsonCorp.com.