OVERVIEW

U.S. stocks declined in a rollercoaster week of trading that saw the VIX index (a measure of volatility) jump above 30 for the first time since early July.

After a good start to the week, the tech sector sold off dramatically on Thursday and Friday, leaving the Nasdaq Composite down 3.27 for the week.

The S&P 500 and Dow had similarly wide price swings, losing 2.31 percent and 1.82 percent for the week, respectively.

Global stocks did poorly as well. Developed country stocks slid 2.12 percent, and emerging market stocks fell 1.97 percent.

Even U.S. Treasuries, traditionally a haven asset, had an up and down week. By mid-week, the 10-year yield had fallen about seven basis points. But by Friday, yields had surged back to about 0.72 percent.

Gold fell about 2.1 percent for the week.

And the U.S. dollar, despite a weak year, rose slightly against other major currencies last week.

KEY CONSIDERATIONS

Stocks Go Down, Too – For a while there, it started to seem like stocks could only go up.

You might have forgiven a person new to investing for thinking just that.

But, of course, that’s nonsense. And last week stocks did what stocks do: they went up, and then they went down.

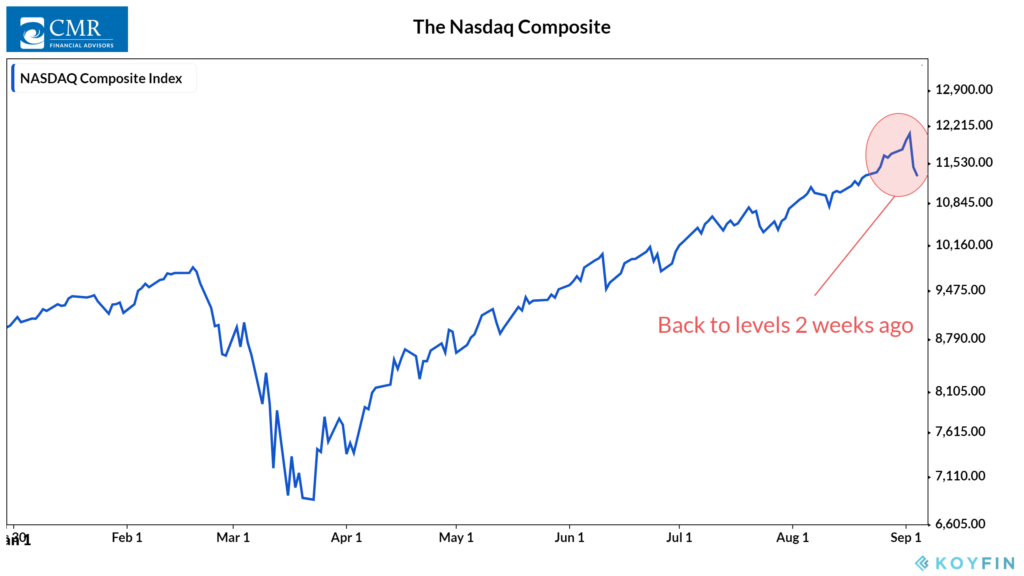

By the end of the week, the Nasdaq Composite had lost roughly 3.3 percent.

In the grand scheme of things, it wasn’t that big of a drop. It brought us back to levels last seen… two weeks ago.

This is because stocks have had such a huge run over the past few months. So even a moderately-sized drop seems paltry when viewed from this larger lens.

To be sure, the selling might not be over. We don’t know if stocks will bounce right back from here or continue to drop further.

But we do know that “Big Tech” has been the driving force of this market.

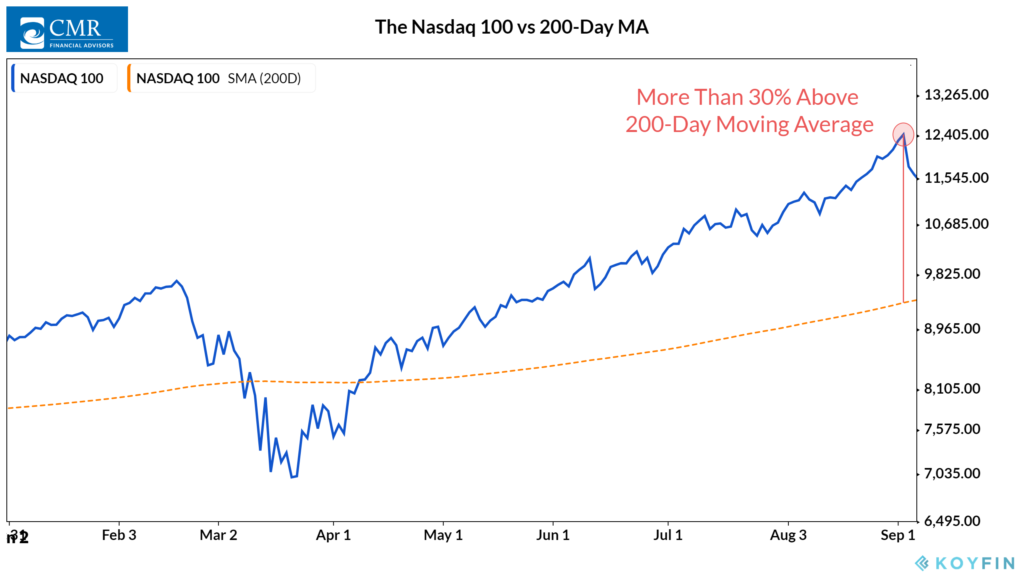

For one, the technology sector had gotten expensive going into last week. The S&P 500 Information Technology index was trading at prices that were 27.5 times what earnings are expected to be in the future.

And this euphoria stands out on a price chart. The Nasdaq 100, representing the 100 largest stocks in the Nasdaq, was trading at more than 30 percent above its 200-day average price before the sell-off.

So it seems that the environment was ripe for a “melt-up” scenario.

And experience suggests that we tend to see some weird things happening during these periods.

Indeed, recent activity in the options markets has made the news lately.

A discussion on this topic is beyond the scope of this post. But it seems to have boiled down to a combination of retail speculation and short-term call buying, coupled with institutions moving to take risk off the table ahead of the election.

In the end, last week serves as a good reminder that risks can materialize into stock declines at any moment.

The majority of the time, though, these declines are just stocks doing what stocks do.

Nonetheless, investors will want to make sure they have a risk management solution in place to protect themselves when those moderate sell-offs turn into portfolio-wrecking bear markets.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Stocks Go Down, Too first appeared on NelsonCorp.com.