OVERVIEW

The U.S. stock market took off and posted its second consecutive weekly gain of three percent.

All 11 S&P 500 sectors ended the week higher, with the real estate sector leading the way on the back of positive housing data.

Developed country stocks saw a significant performance surge last week, gaining over five percent. Emerging market stocks did less well but still had gains of about 2.8 percent.

High-yield (junk) bonds rose 1.8 percent as fund flows reached extremes, and credit spreads continued to drop.

The 10-year Treasury yield remained roughly flat for the week, but the 5-year Treasury yield dipped below 0.3 percent, a record low.

The U.S. dollar fell on the week, which helped boost commodity prices. Oil and grain prices had decent weekly gains.

KEY CONSIDERATIONS

A Peek Under the Hood – From a high level, all three of the major categories we use to measure risk over the intermediate-term are in “neutral” modes.

However, if we look under the hood of this machine, we see that there have been some major improvements recently in the risk category that uses just price-based information.

A significant advancement in this category came last week in an indicator that monitors the broad equity market’s technical health. This indicator looks at the sub-industries that make up the 11 major S&P 500 sectors and then ranks them based on the strength of their trend or momentum scores. For example, the industrial sector breaks down into construction, electrical, trading, office, etc., and each gets a positive, neutral, or negative score.

This indicator’s composite reading bottomed out in April around 30 and has since risen to over 57. This reading of 57 means that about 47 percent of the sub-industry readings are positive and 20 percent are neutral. Historically, the S&P 500 has returned over 13 percent per annum, on average, when this indicator is above a reading of 56 and is higher than it was six weeks ago, which is the case now.

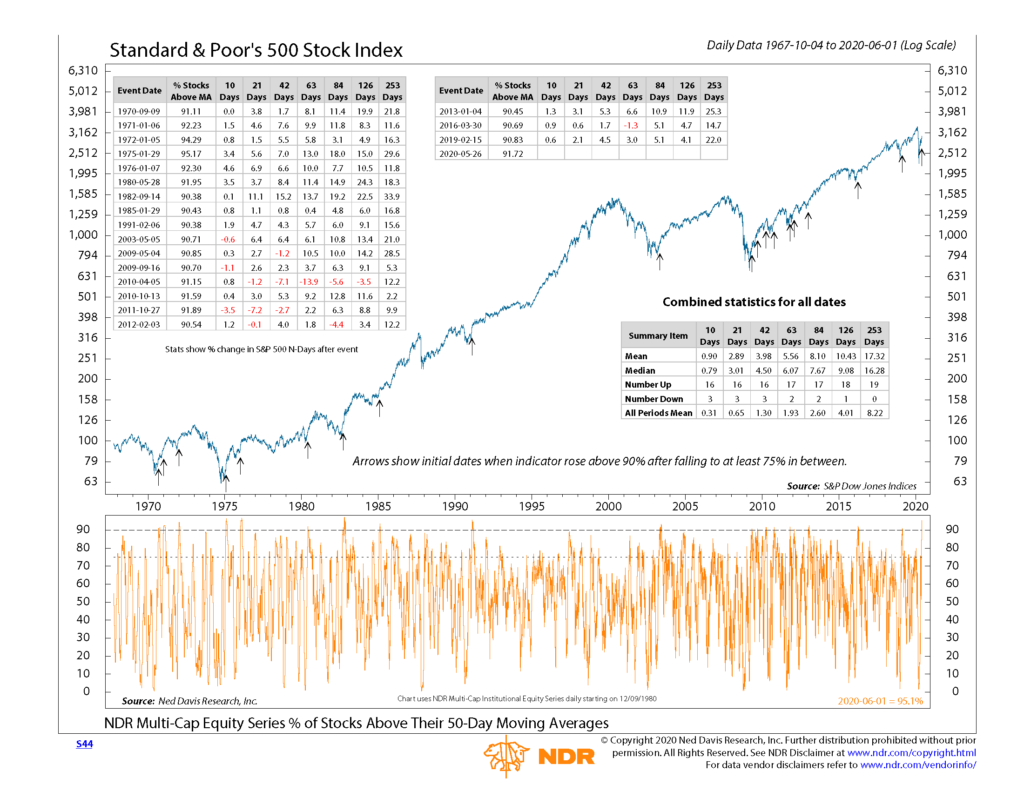

Momentum has certainly picked up. But to see just how dramatically it has shifted, we present an indicator that measures the percentage of institutional-grade stocks that are trading above their 50-day average price. Last week, this hit nearly 92 percent. Of the 19 times this has happened since 1970, the market has always been higher 12 months later, with an average return of roughly 17 percent.

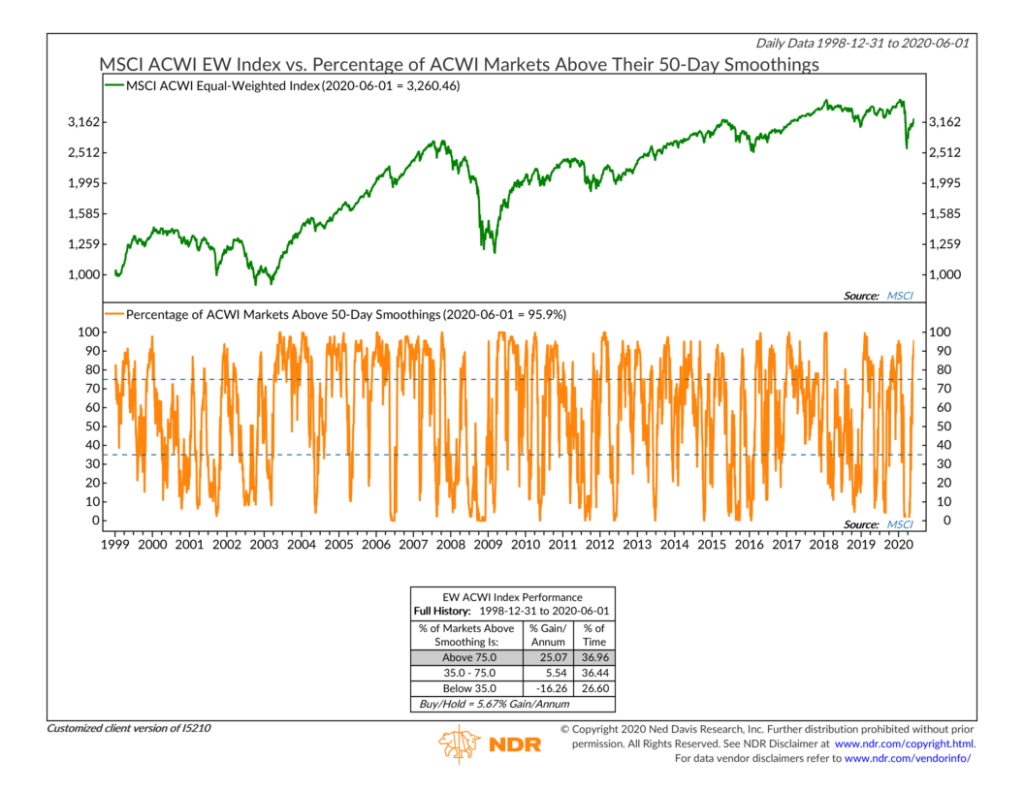

And it’s not just the momentum of the U.S. stock market that has kicked into gear. The percentage of world stock markets above their 50-day average price has jumped to nearly 94 percent. About a month and a half ago, it was virtually zero.

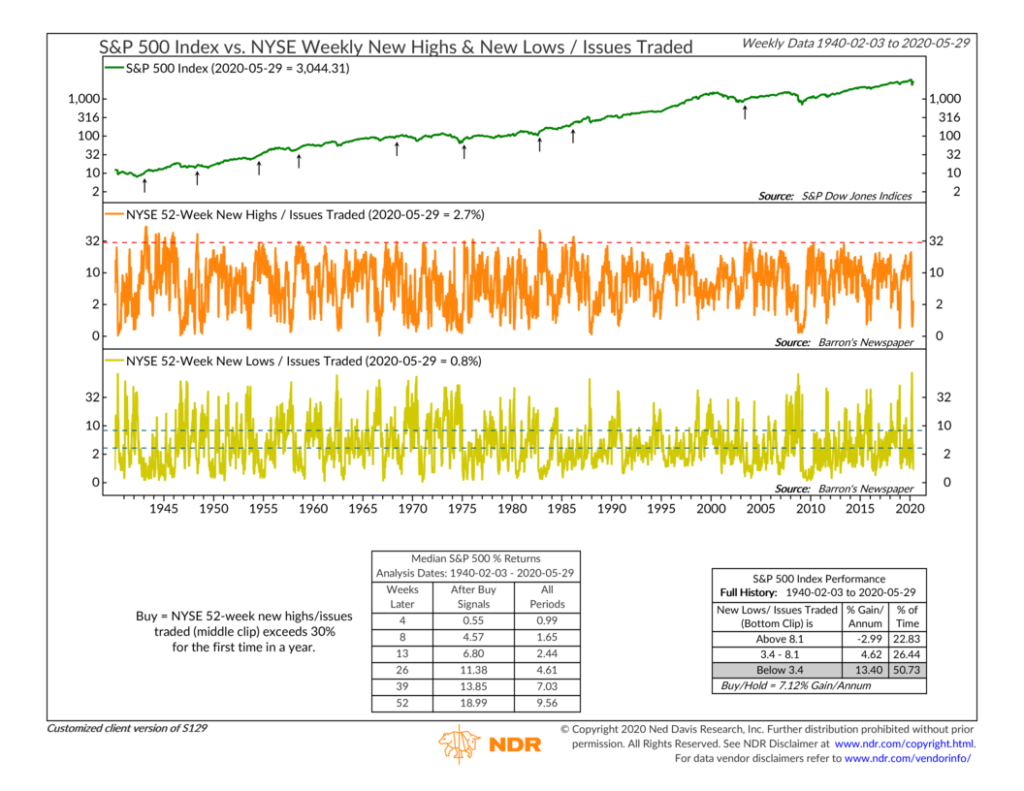

All of this is bullish for the stock market. However, before we get too carried away, a counterpoint to this argument is that the new high list, which measures the percentage of stocks making new 52-week highs, has stalled out and actually fell from the previous week.

To be sure, the percentage of stocks making new 52-week lows remains low, which is still a good sign. But strong and sustainable rallies tend to see new highs expanding, not contracting.

The bottom line is that the weight of the evidence remains mostly neutral at this point. Underneath the hood, we see some bullish moves in momentum and participation. But caution is still warranted since not every piece of the engine is entirely in sync just yet.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post A Peek Under the Hood first appeared on NelsonCorp.com.